Quick Thoughts on the 49ers Season

Before jumping into the more nuanced topic, I feel compelled to allocate the intro to a reflection on the 2025-26 49ers season (I promise it's somewhat relevant and not just a rant).

I've been a 49ers fan my whole life. That Vernon Davis touchdown against the Saints in the playoffs was one of the most memorable moments in my childhood. Yet, despite the fourth highest point differential over seven seasons which includes 2 Super Bowl appeareances, five playoff appearances, and four NFC championship games, we simply cannot get over the hump.

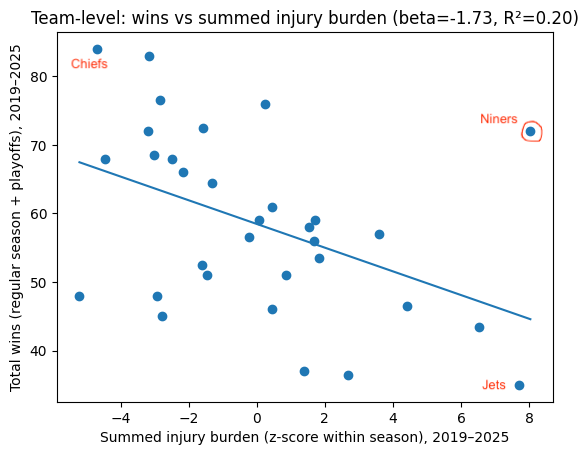

Although there is inherent variance in sports outcomes, with many confounding variables, the bizzare and perennial injury woes of the Niners continues to be the most obvious culprit for the many "almosts." Moreover, these injuries seem independently distributed for each player; it's frequently different players hurt from one season to the next (diminishing the merit of "fragility" concerns for individuals). We will later quantify the true absurdity of the 49ers health misfortunes.

Many theories, between tissue-melting EMF exposure to scheduling conspiracies, have circulated with varying degrees of virality and sensibility. These, to me, exhibit the human proclivity to ascribe blame to the statistically inexplicable. In the past seven seasons, the 49ers have been top-five in AGL (adjusted games lost) six times while no other team has finished top-five more than twice in that span except the Jets with 3. The only season where the 49ers were not among the five most injured NFL teams was 2023 where the 49ers lost in OT of the Super Bowl to the Chiefs. What is more remarkable is the sustained success of the 49ers despite their injuries (no team has a larger error for LinReg between AGL and losses. Also, I know the correlation is certainly non-linear).

Assuming injuries are purely random, the probability of finishing top five in injuries at least 6/7 years is ~.0088%. Even over a 59 year span, the probability of this injury streak at any point is .32%. Multiply .0088 by the probability of finishing among the top 2-4 teams almost every year and adjust for the negative correlation between injuries and success and we find ourselves with a true anomaly in America's favorite sport.

This season, culminating in a divisional round loss to Seattle after 20M more than 2nd worst), feels more malign and pernicious than those past. Perhaps it's because the gruesome conclusion imbues in fans a somber and hollow resignation that our stars are aging or leaving and that our glory years of gushing talent were oft-ruined by freak injuries right at the death of each season.

Hedging Against injuries

The funny thing about sports teams is their1thanks Micah for correcting. Still won't use AI to write. intended motivation is winning, but that doesn't always correlate to more money. For an NFL team and its players, they have some financial exposure to injury risk--player bonuses, contract incentives, ticket sales (maybe?), player commercial deals, and incremental merchandise revenue (also maybe?) all depend on team success (which we discovered is correlated to staying healthy). One might surmise that a team would want to hedge any financial exposure to freak injuries--especially a team like the 49ers.

The simplest way this is done today is with injury insurance. As we mentioned earlier, the 49ers had $95 million in 2025 salary sidelined becasue of injury. NFL contracts are interesting in that players are paid a large sum of gauranteed money with added incentives.

Injury insurance for a team is structurally unique. With most insurance products, there is a clear monetary loss associated with the triggering event. For example, car insurance enables a policy holders to buy another car due to a loss in value from an accident. Health insurance financially protects policy holders from untenable medical bills. For this coverage, insurers require a premium payment. One might imagine that the large sample of many policy holders enables underwriters to more confidently price peril risk; surely not everybody's home is burning down at the same time, right? This large customer base should reduce variance in the total claim value for a given year.

Well, injury insurance for NFL teams is pretty different. What exactly is the covered damages here? The total franchise value nor NFL TV deal doesn't decrease based on player availability, so it's not asset depreciation. Moreover, there isn't a large pool of valuable "replacement players" a team can claim off waivers in the event their star goes down, so the claims are evidently not to enable roster additions (waiver players are often on minimum contracts plus teams have a salary cap anyways). My deduction here is that these insurance policies are primarily emotional. I'd contend that a bad team leads to poor ticket sales, so simply hedging on-field performance would be a better policy if ticket revenue were a concern. Additionally, a superstar on a rookie contract has a similar impact and appeal to a superstar on a max contract, yet teams only purchase insurance policies against the latter. One potential reason is an NFL cap loophole, whereby a salary "refund" claim can be added on the following year's salary cap. However, teams like the 49ers have tens of millions of dollars of unused cap space, so a single-season cap relief that doesn't persist to multi-year contracts seems materially irrelevant except for franchise tagging flexibility.

So I imagine the rationale is akin to the following: I'm a billionaire NFL owner who wants to win shiny trophies and am fairly cost-insensitive. I have some really good players, a subset of which I pay a lot. If they got hurt, my bottom-line likely won't change much. But, my team might win less games which would make me very sad. What might make me less sad? Seven million dollars. I can't really do a whole lot with seven million dollars next year, but it's better than nothing.

Granted, this is speculation. But Nick Bosa's (all-pro 49ers DE) insurance policy played out almost exactly like this. Did Bosa's injury decrease ticket sales? Not at all. Did the payout enable the 49ers to buy a replacement DE? Not at all. Is seven million dollars cool? I guess.

An interesting stat I read is 75% of teams insure at least one of their big contracts with only two real brokers for these policies. I'm not sure if this would be legal, but I'd have to imagine that these brokers would consider charging higher premiums to the 49ers simply because of their strange injury history. Is this ethical? Probably not. Is it what I would do? Certainly. Even if past injuries yield no indication on future injuries, surely the 49ers ownership are fearful buyers at this point. And well, something like supply and demand.

Prediction Markets as a natural hedge

However, if the 49ers ownership is so inclined to hedge their emotional exposure to player injuries, there are other ways to make seven million dollars from niche sports outcomes. Especially if your two brokers decide to jack up your premiums, maybe these other ways seem more appealing. One of these ways is utilizing public markets rather than private markets to underwrite risk and offer insurance.

Where can someone access public market sports outcome insurance? Well, Kalshi and Polymarket seem like good answers. Owners of NFL teams are barred from sports betting. However, in the eyes of the CFTC and legal system in the US, Kalshi and Polymarket are not sports betting platforms.

In fact, enabling people to diversify and hedge their exposure to specific events (including sports outcomes) is precisely the supposed purpose of these exchanges. These are CFTC regulated contracts; a financial instrument with true market purposes and only a tiny resemblance to betting.

Publicly tradable insurance contracts in sports could serve as a microcosm for a democratization of risk underwriting: public markets should have better price discovery than a guy with Excel at an insurance firm. Regardless, I think it would be funny to see NFL fans functioning as a pseudo-bookmaker for NFL owners.